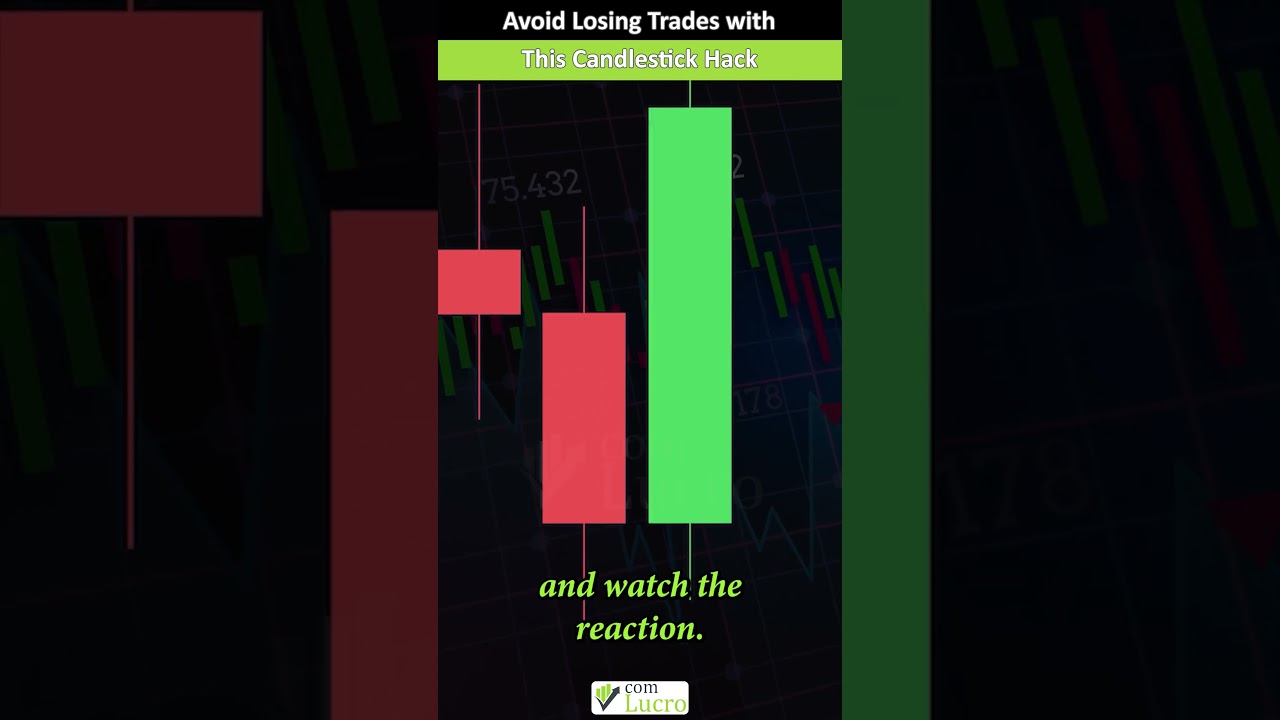

Avoid Losing Trades with This Candlestick Hack

📈 Candlestick Hack Every Trader Needs to Know 🕯️

🔔 Subscribe for more trading tips and strategies!

In this video, discover why trading based solely on a candlestick’s appearance can lead to poor decisions. Learn how to analyze market reactions instead of focusing on the candle itself. Avoid common mistakes and improve your trading results today!

👉 Key Takeaways:

The difference between candlestick analysis and reaction analysis.

Why waiting for market reactions is critical.

A practical example of trend continuation confirmation.

Essential advice to enhance your trading strategies.

🚀 Start improving your performance now!

💬 Connect with Us:

Website: https://www.comlucro.com.br/

Twitter: https://twitter.com/canalcomlucro

#CandlestickPatterns #TradingHack #PriceAction #TradingStrategies #MarketReactions #TradingEducation #DayTrading #SwingTrading

00:00 - Hey Trader!!! Hey Trader! Let

me tell you about a candlestick hack that can significantly improve

your chances of success in trading. You see, one common mistake

traders make is focusing on the candlestick itself instead of its

reaction. Let me show you what I mean. So, the market’s in a downtrend, and then

we see a candlestick form with a large lower

00:16 - wick. It seems to signal strength and the

potential for an upward move. At this point, some traders immediately jump in and go long. But that’s the mistake—trading

based on the candlestick alone. What you should do is wait and watch the reaction. Even though this candlestick looks

bullish, if the price breaks below

00:32 - the wick’s low, it’s a clear signal

of a continuation in the downtrend. And guess what? That’s exactly what

happens—the market pushes even lower. The lesson here? Don’t trade the

candlestick. Trade the reaction. Please, keep our top recommendations in

mind, and best of luck in your trades!

Perguntas Respondidas por esse Artigo

-

Por que negociar baseado apenas na aparência de um candlestick pode levar a decisões ruins?

-

Qual a diferença entre análise de candlestick e análise de reação do mercado?

-

Por que é crucial esperar pelas reações do mercado ao invés de agir diretamente no padrão do candlestick?

-

Onde posso encontrar mais dicas e estratégias de negociação?