What Is an Order Block? The Secret to Precision Entries in Trading

📌 Order Blocks Explained: The Key to Smart Trading!

Hey Trader! Ever wondered why price reacts strongly at certain levels? It’s no coincidence—institutions use Order Blocks to execute large buy or sell orders, creating powerful zones of support and resistance.

💡 What you’ll learn in this video:

✅ What Order Blocks are and how they work

✅ How institutions use them to influence price movements

✅ The key differences between Order Blocks and regular support/resistance

✅ How to incorporate Order Blocks into your strategy for high-probability setups

🔔 Watch now and refine your trading edge!

🔥 Don’t forget to subscribe and turn on notifications for more smart trading insights!

📺 More from ComLucro: comlucro.com.br

#OrderBlocks #SmartMoney #Trading #Forex #StockMarket #PriceAction #InstitutionalTrading #SupportAndResistance #TechnicalAnalysis

00:00:00,120 --> 00:00:04,560

Hey Trader! Do you know what an Order Block is?

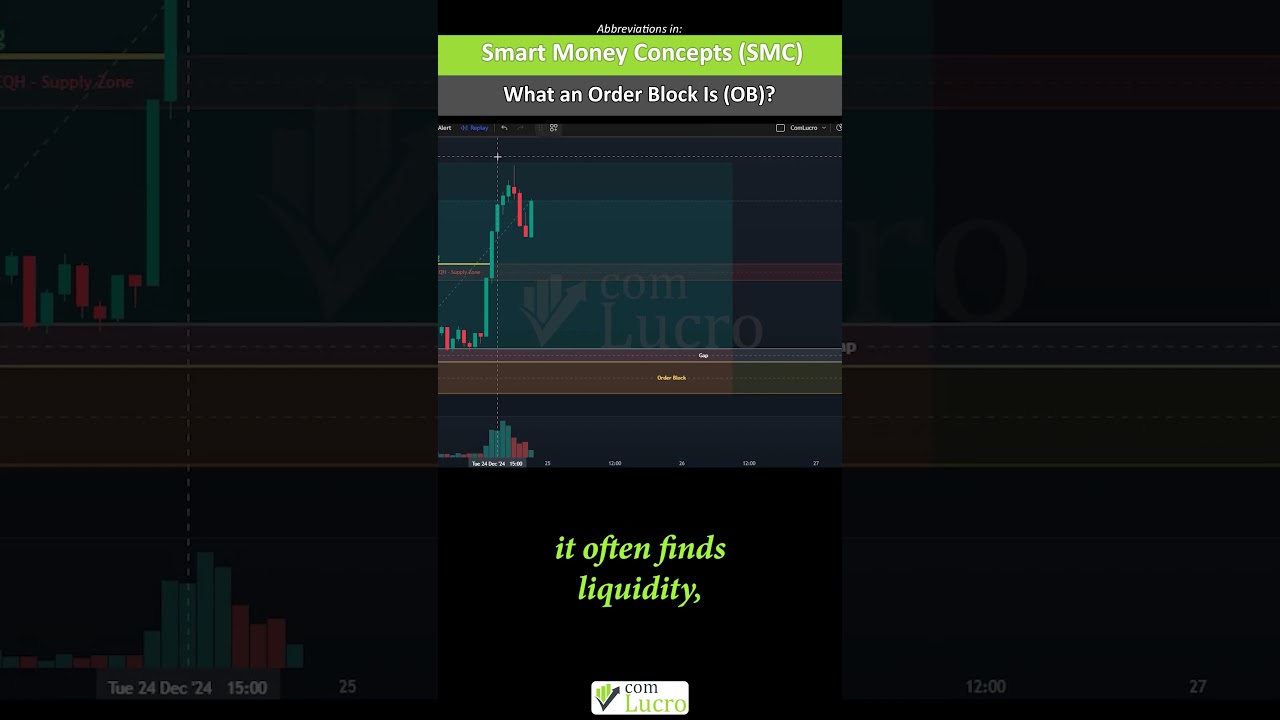

Order Blocks are price zones where institutions

00:00:04,560 --> 00:00:09,520

place significant buy or sell orders, creating

strong areas of support or resistance. These zones

00:00:09,520 --> 00:00:14,120

often act as key points where the market reacts

before continuing its trend. An Order Block forms

00:00:14,120 --> 00:00:18,480

when institutions accumulate or distribute

positions before a major price movement.

00:00:18,480 --> 00:00:23,800

When price returns to this area, it often finds

liquidity, leading to a high-probability reaction.

00:00:23,800 --> 00:00:28,760

This is why traders use Order Blocks to refine

their entries and align with institutional flow.

00:00:28,760 --> 00:00:33,160

However, the key characteristic of a strong Order

Block is its ability to act as a reaction zone

00:00:33,160 --> 00:00:37,400

where price respects institutional levels.

Unlike random support and resistance areas,

00:00:37,400 --> 00:00:41,120

Order Blocks are formed by high-volume

transactions, making them more reliable for

00:00:41,120 --> 00:00:45,080

trade entries. That’s why combining Order

Block analysis with market structure is

00:00:45,080 --> 00:00:49,040

essential for identifying high-probability

setups and improving trade precision.

00:00:49,040 --> 00:00:52,640

Want to master this concept? Watch

our video “Order Blocks Explained,”

00:00:52,640 --> 00:00:55,200

where we break it down in detail! And as always,

00:00:55,200 --> 00:00:58,240

keep our top recommendations in

mind. Best of luck in your trades!