The Hidden Trap of Winning Streaks in Trading: Avoid Ruin!

The Hidden Trap of Winning Streaks in Trading: Don’t Let Euphoria Destroy You!

Ever felt invincible after a series of successful trades? That feeling, fueled by euphoria, can be far more dangerous than a losing streak. Dr. David Paul, in this insightful video, exposes the hidden trap of winning streaks and how they can lead to disastrous trading decisions. Prepare to have your perspective on trading success completely reshaped.

The Illusion of Control and the Pituitary Gland

The core issue lies within our own biology. As Dr. Paul explains, after a winning streak, the pituitary gland kicks into overdrive, releasing chemicals that induce a feeling of euphoria. This euphoria creates a dangerous illusion of control, leading traders to abandon established risk management protocols.

This feeling of invincibility is what causes traders to increase position sizes recklessly, forgetting the disciplined approach that led to the initial success. It’s a classic case of behavioral finance at play, where emotions override rational decision-making.

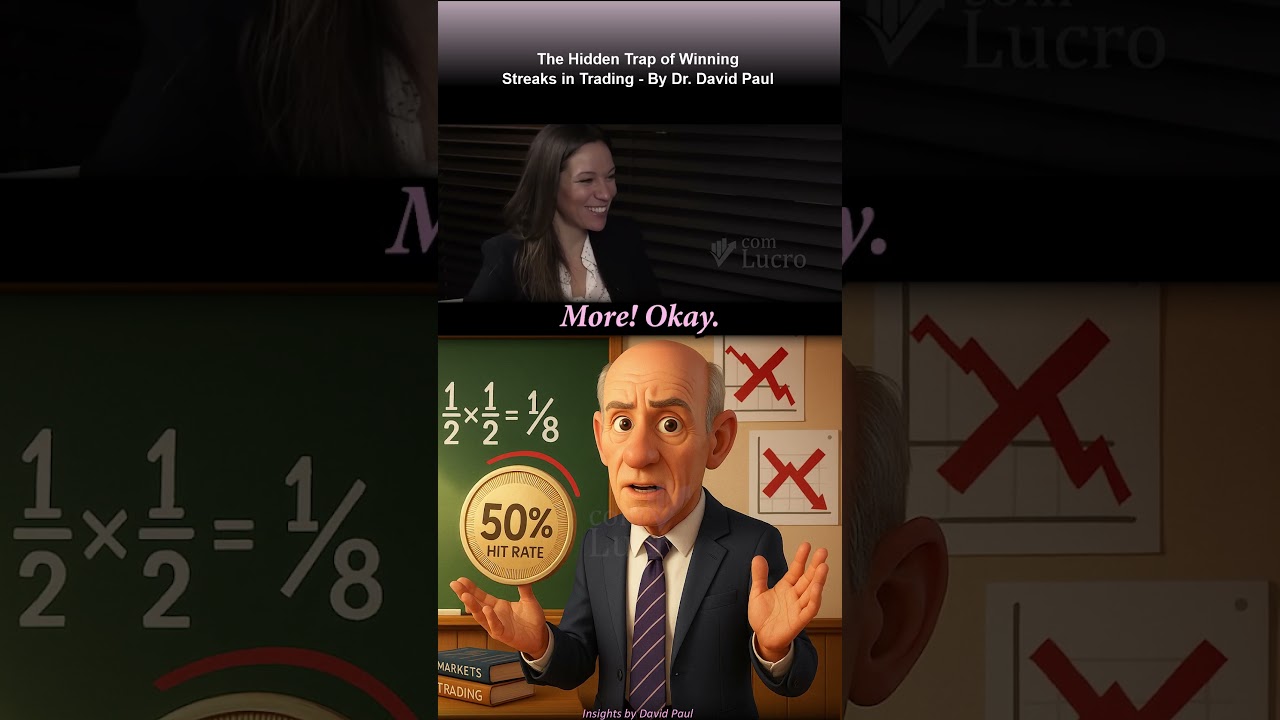

The 50% System and the Reality of Losing Streaks

Dr. Paul uses the example of a 50% hit rate system to illustrate the inevitability of losing streaks. Even with a system that is right half the time, consecutive losses are statistically guaranteed. He breaks down the probability:

- Two consecutive losses: 25% probability

- Three consecutive losses: 12.5% probability

- Four consecutive losses: 6.25% probability

- Five consecutive losses: 3.125% probability

The critical takeaway is that losing streaks are not a sign of a broken system; they are a natural part of trading, especially in trend-following strategies, where hit rates are often below 50%. The key is to manage these inevitable drawdowns without abandoning the system or taking excessive risks.

The Real Danger: Bankrupt After Success, Not Failure

The most shocking revelation is that most traders go bankrupt after a run of good luck, not bad luck. Why? Because the euphoria leads to overconfidence and a disregard for sound risk management. They believe they are infallible and take on risks they would never consider under normal circumstances. Dr. Paul candidly admits this has happened to him, highlighting that even experienced traders are susceptible to this trap.

Position Sizing: The Key to Staying Grounded

The antidote to the euphoria-induced recklessness is rigorous adherence to position sizing rules. Whether you risk half a percent or some other predetermined amount, sticking to the plan is crucial. Don’t let a winning streak tempt you to deviate from your risk management strategy.

Remember that even the best systems will experience periods of drawdown. The ability to weather these storms without emotional interference is what separates successful traders from those who ultimately fail.

Why You Absolutely MUST Watch This Video!

This isn’t just another trading video; it’s a crucial lesson in trading psychology that can save you from financial ruin. Dr. David Paul provides practical insights on how to recognize and combat the dangerous effects of euphoria, allowing you to maintain discipline and protect your capital. He also touches on a crucial element, the ghastly clusters of bad luck that you might encounter while trading. In the video, you’ll learn:

- The neurological basis of trading euphoria and its impact on decision-making.

- How to calculate the probability of losing streaks and prepare for inevitable drawdowns.

- Practical strategies for maintaining discipline and avoiding reckless risk-taking.

Don’t let a winning streak become your downfall. Watch the full video now and equip yourself with the knowledge to navigate the hidden traps of trading success! Your portfolio will thank you.