Mastering Trading Psychology: The Key to Consistent Profits

Mastering Trading Psychology: The Key to Consistent Profits

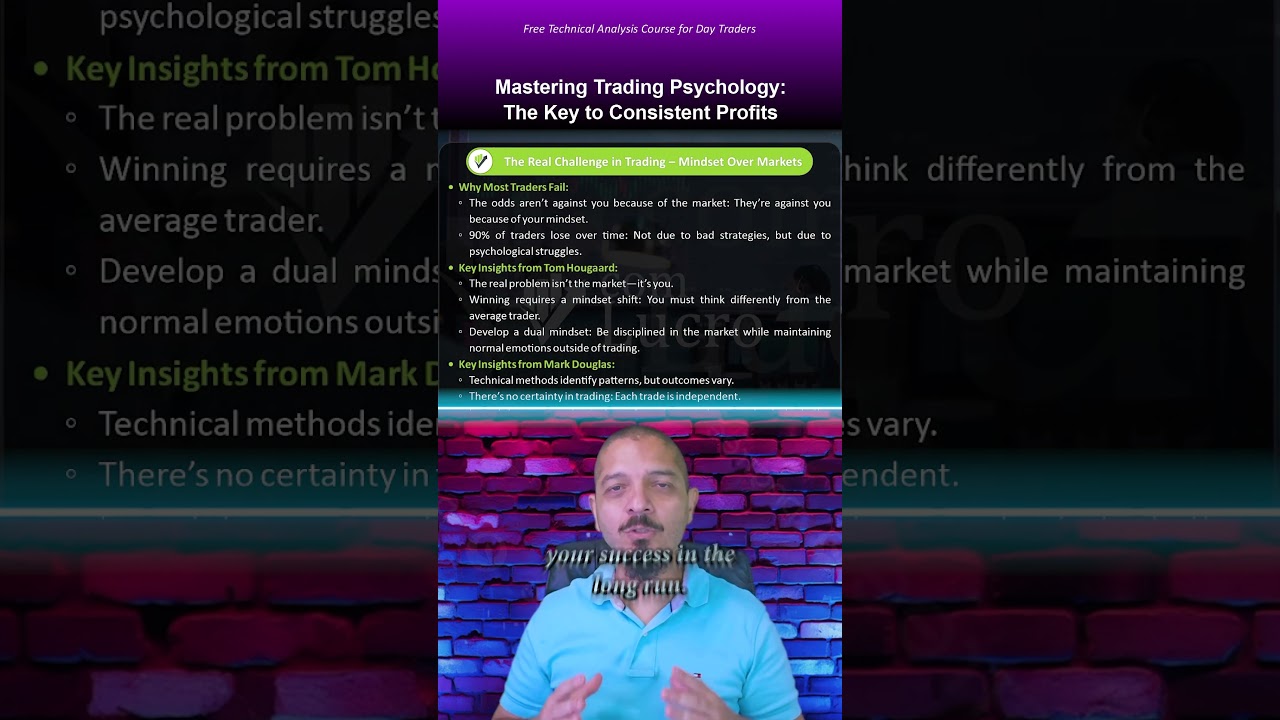

Are you struggling to achieve consistent profitability in your trading? You might have a solid strategy and understand market analysis, but are you truly mastering your mind? Trading psychology is often underestimated, yet it’s the bedrock of successful and sustainable trading. This article delves into the critical aspects of trading psychology, drawing insights from a comprehensive video that explores how your mindset impacts your performance.

Why Trading Psychology Matters

Trading is not merely about reading charts or identifying patterns. It’s about managing emotions, maintaining discipline, and making rational decisions, often under immense pressure. Many traders fail not because their strategies are flawed, but because they succumb to fear, greed, hesitation, or overconfidence. In essence, the psychological side of trading separates consistent winners from those trapped in a cycle of frustration and losses.

The Emotional Rollercoaster of Trading

The market can be an emotional rollercoaster. Fear can paralyze you, preventing you from entering potentially profitable trades or causing you to exit prematurely. Greed can lead to overtrading, taking on excessive risk, and deviating from your established strategy. Hesitation can make you miss opportunities, while overconfidence can blind you to warning signs.

The Importance of Self-Discipline

Self-discipline is paramount. It involves sticking to your trading plan, managing risk effectively, and avoiding impulsive decisions driven by emotions. A well-defined trading plan, including entry and exit points, position sizing, and risk management rules, is crucial for maintaining discipline.

Key Mental Challenges Traders Face

The video referenced identifies key mental challenges that traders must overcome:

- Emotional Decision-Making: Learning to detach emotions from your trading decisions is essential. Implement strategies like journaling your trades, identifying emotional triggers, and practicing mindfulness to improve your emotional control.

- Self-Discipline: Sticking to your trading plan requires unwavering discipline. Set clear goals, track your progress, and reward yourself for adhering to your rules.

- Risk Management: Properly managing risk is non-negotiable. Determine your risk tolerance, use stop-loss orders, and diversify your portfolio to protect your capital.

Practical Strategies for Mastering Trading Psychology

Here are some practical strategies you can implement to enhance your trading psychology:

- Develop a Trading Plan: A comprehensive trading plan acts as your roadmap, guiding your decisions and minimizing impulsive actions.

- Journal Your Trades: Record your trades, including your rationale, emotions, and the outcome. This helps you identify patterns and learn from your mistakes.

- Practice Mindfulness: Mindfulness techniques can help you stay present and focused, reducing the impact of emotions on your trading decisions.

- Manage Your Environment: Create a calm and distraction-free trading environment to improve your focus and concentration.

- Seek Support: Connect with other traders, mentors, or coaches who can provide guidance and support.

The Path to Consistent Profits

Mastering trading psychology is a journey, not a destination. It requires continuous self-reflection, learning, and adaptation. By understanding your emotions, developing self-discipline, and implementing effective risk management strategies, you can significantly improve your trading performance and achieve consistent profitability.

Ready to Elevate Your Trading? Watch the Full Video!

This article only scratches the surface. In the full video, you’ll delve deeper into practical techniques for managing fear, greed, and other common emotional pitfalls. You’ll also learn advanced risk management strategies and gain a comprehensive understanding of how your mindset directly impacts your bottom line. Don’t miss out! Watch the full video now to unlock the secrets to consistent trading profits.