Avoid Losing Trades with This Candlestick Hack

Unlock Trading Success: The Candlestick Reaction Hack

Are you tired of seeing potential winning trades turn into losses? Many traders fall into the trap of focusing solely on the candlestick pattern itself, leading to costly mistakes. This article will reveal a simple yet powerful candlestick hack that can significantly improve your trading accuracy and protect your capital.

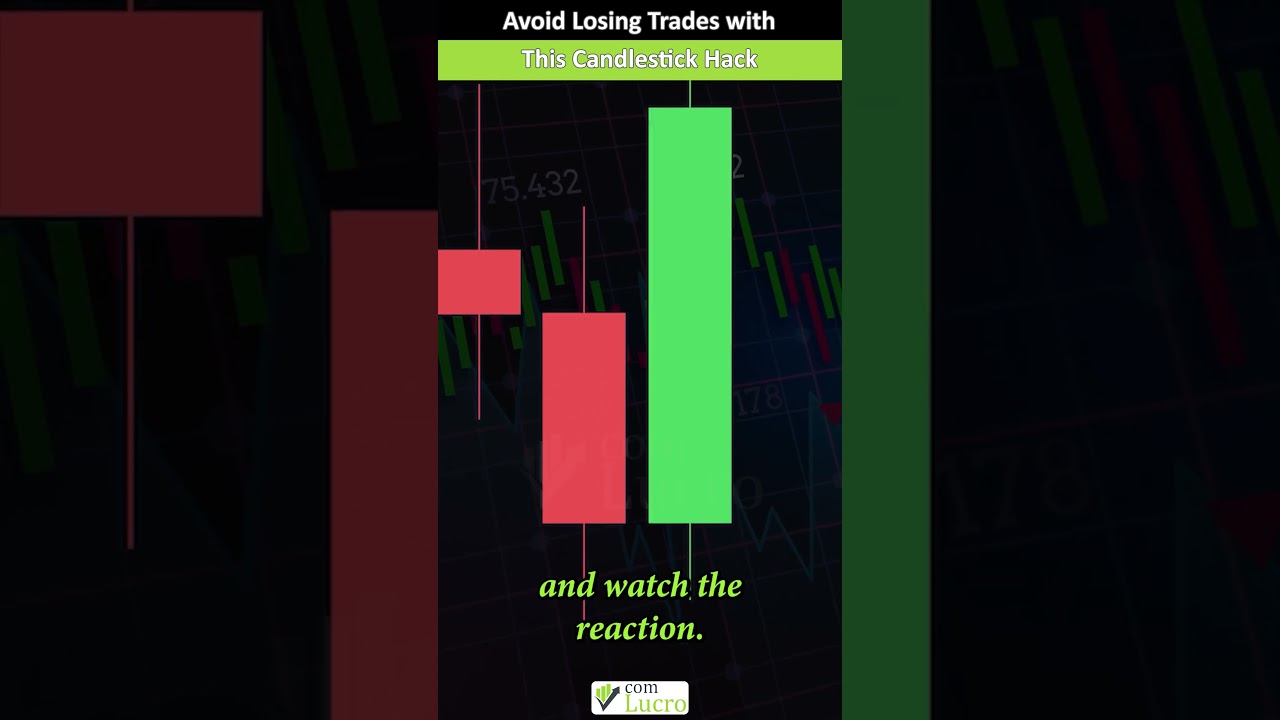

The key? Don’t trade the candlestick; trade the reaction!

Before we dive deeper, take a moment to watch the complete video above. It provides a visual demonstration of this crucial concept and reinforces the principles we’ll be discussing. You’ll see real-world examples and gain a clearer understanding of how to apply this hack to your own trading strategy. Don’t miss out on this valuable insight!

The Common Mistake: Focusing on the Candlestick Alone

A frequent error traders make is interpreting a candlestick pattern in isolation. For example, a candlestick with a long lower wick in a downtrend might appear bullish, suggesting a potential reversal. However, blindly entering a long position based solely on this signal can be risky.

Understanding the Context: Downtrend Example

Imagine a market in a clear downtrend. A candlestick with a large lower wick forms, seemingly indicating buying pressure. Many traders jump into a long position, anticipating an upward move. This is where the problem begins.

The Candlestick Reaction Hack: Trade the Reaction, Not the Candlestick

Instead of immediately acting on the candlestick pattern, the key is to wait and observe the market’s reaction. Even if the candlestick appears bullish, a break below the low of the wick signals continuation of the downtrend.

Example: Downtrend Continuation

In the downtrend scenario, if the price breaks below the low of the candlestick’s lower wick, it’s a strong indication that the downtrend is likely to continue. This simple observation can save you from entering a losing trade.

Why This Hack Works: Validating Market Sentiment

This hack forces you to validate the implied sentiment of the candlestick pattern. A bullish candlestick isn’t necessarily a guarantee of an upward move. By waiting for the market’s reaction, you’re confirming whether the buying pressure is truly strong enough to reverse the trend.

Practical Application: Risk Management

By implementing this strategy, you’re effectively managing your risk. You’re avoiding premature entries and waiting for confirmation before committing capital. This can lead to higher win rates and reduced losses.

Benefits of Implementing This Candlestick Hack

- Improved Accuracy: Enhance your trading accuracy by validating candlestick signals.

- Reduced Risk: Protect your capital by avoiding premature entries.

- Higher Win Rates: Increase your win rates by trading based on market reactions.

- Enhanced Confidence: Trade with greater confidence knowing you’re making informed decisions.

Don’t Miss Out: Watch the Video Now!

This article provides a foundational understanding of the candlestick reaction hack. To see this strategy in action and gain a deeper understanding of its application, watch the video above. You’ll learn:

- How to identify key candlestick patterns.

- How to analyze the market’s reaction to these patterns.

- How to implement this hack into your trading strategy.

Investing a few minutes to watch the video can significantly improve your trading performance. Don’t miss out on this valuable opportunity to enhance your skills and protect your capital!

Remember, don’t trade the candlestick. Trade the reaction. Best of luck in your trades!