Candlestick Strength: The Secret to Smarter Trades!

Unlock Smarter Trades: Mastering Candlestick Strength

Are you ready to elevate your trading game? Understanding the nuances of candlestick patterns can provide you with a significant edge in the market. This article, inspired by a powerful video, breaks down the secrets of candlestick strength and how it can guide your trading decisions. Discover how to interpret the subtle shifts in market sentiment reflected in these patterns and turn that knowledge into profit.

Want to master candlestick analysis? The video above holds the key! Learn to identify buyer and seller strength, understand indecision, and improve your entry and exit points. Don’t miss out on this invaluable knowledge – watch now!

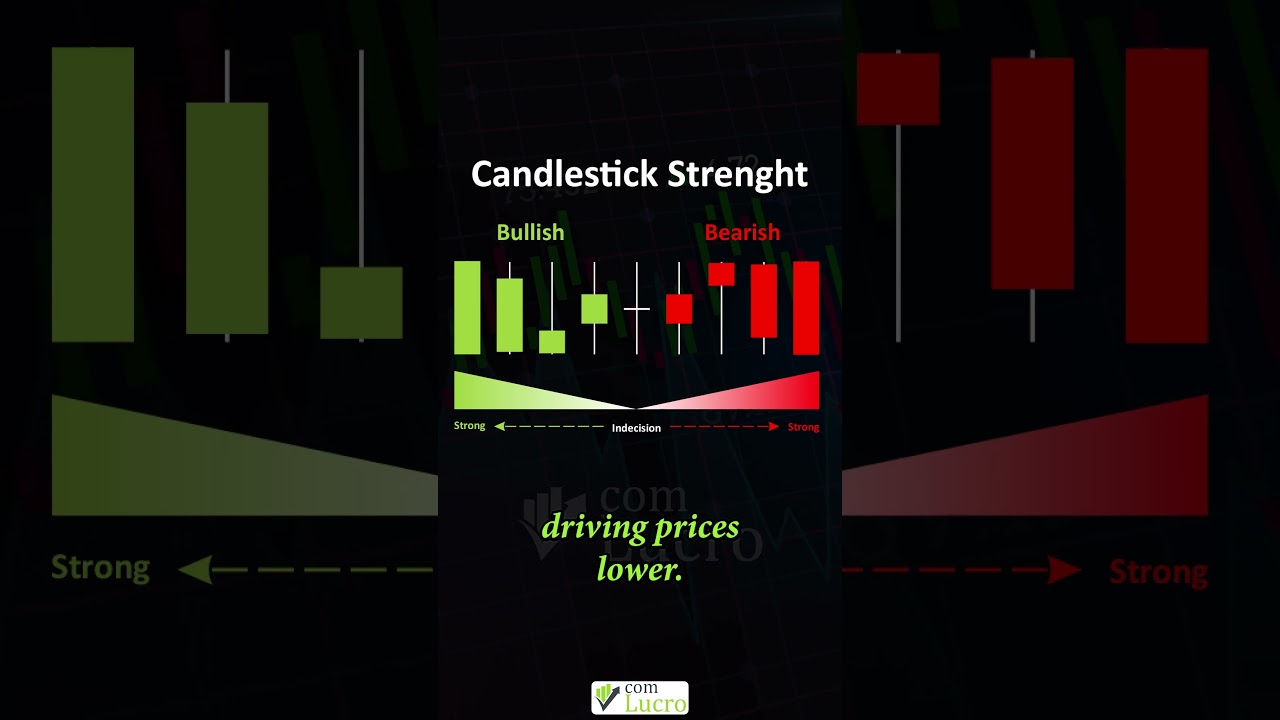

Decoding Candlestick Signals: What the Shapes Tell You

Candlesticks are more than just graphical representations of price movements; they tell a story about the battle between buyers and sellers. The shape and size of a candlestick, along with its wicks (or shadows), reveal crucial information about the prevailing market sentiment. Let’s delve into the key elements:

- Strong Green Candles: These indicate strong buying pressure. Buyers are in control, confidently pushing prices higher. The larger the body of the candle, the more decisive the buying action.

- Smaller Green Candles with Wicks: As green candles become smaller or develop wicks, it suggests that buyers are starting to lose momentum. This could signal a potential reversal or consolidation.

- Doji Candles: The Doji represents indecision in the market. Buyers and sellers are evenly matched, resulting in a small or nonexistent body. This pattern often appears at the end of a trend and can indicate a potential shift in direction.

- Smaller Red Candles with Wicks: These candles show that sellers are beginning to take control, although the selling pressure is not yet overwhelming. The wicks indicate that buyers are still attempting to push back.

- Strong Red Candles: Large, strong red candles demonstrate significant selling dominance. Sellers are driving prices lower with conviction.

Putting Candlestick Strength into Practice

Understanding the strength of candlesticks allows you to refine your trading strategies. Here’s how you can apply this knowledge to your trading:

Identifying Entry Points

Look for strong green candles in an uptrend to confirm the continuation of the trend and identify potential entry points for long positions. Conversely, strong red candles in a downtrend can signal opportunities to enter short positions.

Refining Exit Points

Be cautious when you see smaller candles with wicks forming against the prevailing trend. This could indicate a weakening of the trend and a potential reversal. Consider tightening your stop-loss orders or taking profits.

Recognizing Market Indecision

The appearance of a Doji candle should prompt you to exercise caution. Avoid entering new positions until the market direction becomes clearer. Wait for confirmation from subsequent candles or other technical indicators.

The Importance of Context

Remember that candlestick patterns should not be interpreted in isolation. The context in which a candle appears is crucial. Consider factors such as:

- Overall Trend: Is the market trending up, down, or sideways?

- Support and Resistance Levels: Are candles forming near key support or resistance areas?

- Volume: Is the volume confirming the price action? High volume typically supports the strength of a candlestick pattern.

- Other Technical Indicators: Use other technical indicators, such as moving averages or oscillators, to confirm your candlestick analysis.

Why You Need to Watch the Full Video

This article provides a solid foundation for understanding candlestick strength, but the video offers a deeper dive into the subject. In the video, you’ll learn:

- Visual examples of various candlestick patterns and how to interpret them.

- Real-world trading scenarios where candlestick analysis can be applied.

- Tips for combining candlestick patterns with other technical indicators for improved accuracy.

Ready to take your trading to the next level? Don’t just read about it – see it in action! Watch the video now and unlock the full potential of candlestick strength! Your profits await!

Elevate Your Trading Knowledge

Mastering candlestick strength is a crucial step towards becoming a successful trader. By understanding the stories that candlesticks tell, you can make more informed trading decisions and improve your overall profitability. Watch the video, practice your analysis, and remember to always consider the context in which the candles appear.