Master Wyckoff’s Three Laws to Improve Your Trading! #daytrading #forex #bitcoin

Unlock Market Movements: Master Wyckoff’s Three Laws

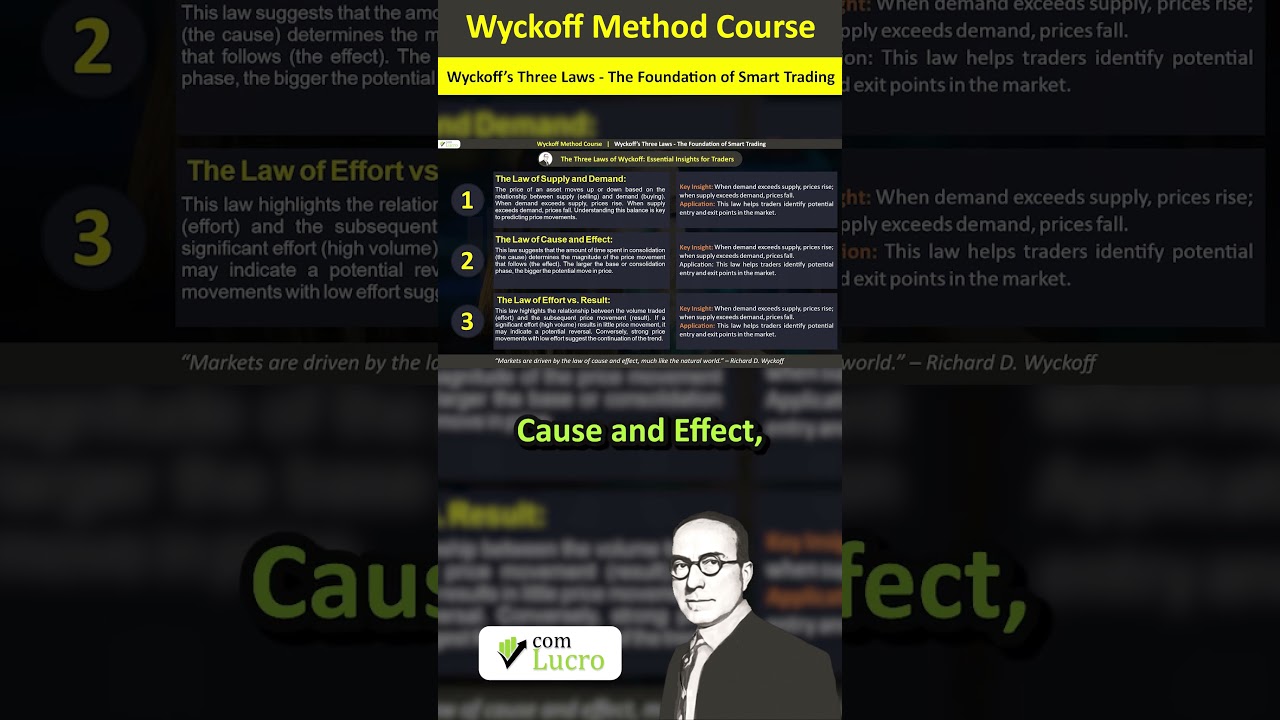

Are you ready to take your trading to the next level? Understanding market dynamics is crucial for consistent profitability. One of the most powerful frameworks for analyzing market behavior is the Wyckoff Method, particularly its Three Laws. This article will delve into these laws, providing you with actionable insights to improve your trading strategy. Discover how supply and demand, cause and effect, and effort versus result can revolutionize your approach to the markets.

Before diving deeper, we highly recommend watching the video above. It provides a visual and in-depth explanation of Wyckoff’s Three Laws, making it easier to grasp the concepts and see how they apply in real-world trading scenarios. Don’t miss out on this valuable resource! Watch it now and gain a competitive edge.

Wyckoff’s First Law: Supply and Demand

The Law of Supply and Demand is the cornerstone of all market analysis. It states that prices move based on the relationship between the availability of an asset (supply) and the desire to own it (demand). When demand exceeds supply, prices rise. Conversely, when supply exceeds demand, prices fall.

Identifying areas of strong supply and demand is essential. These areas often manifest as support and resistance levels on price charts. By recognizing these zones, traders can anticipate potential price reversals or breakouts and position themselves accordingly.

Practical Application:

Look for areas where price has repeatedly bounced or stalled. These are likely zones of significant supply or demand. Use volume analysis to confirm the strength of these zones. High volume at a support level, for example, suggests strong buying pressure and a potential bounce.

Wyckoff’s Second Law: Cause and Effect

The Law of Cause and Effect suggests that price movements are not random. They are the result of a period of accumulation or distribution. Accumulation is when informed investors are quietly buying an asset, preparing for an eventual price increase. Distribution is when they are selling their holdings, anticipating a price decline.

The “cause” is the period of accumulation or distribution, and the “effect” is the subsequent price movement. Wyckoff developed charting techniques, such as Point and Figure charts, to quantify these causes and project potential price targets.

Practical Application:

Identify accumulation and distribution ranges on your charts. Look for patterns like sideways consolidation, narrow trading ranges, and increasing volume during accumulation. Use Point and Figure charting to estimate the potential magnitude of the subsequent price move based on the size of the accumulation or distribution range.

Wyckoff’s Third Law: Effort Versus Result

The Law of Effort Versus Result compares the volume of trading activity (effort) with the resulting price movement (result). If there is a divergence between effort and result, it can signal a potential change in trend. For example, if a rally is accompanied by low volume, it may indicate a lack of conviction and a potential reversal.

Conversely, if a significant price decline occurs with relatively low volume, it might suggest that the selling pressure is waning, and a reversal could be imminent.

Practical Application:

Pay close attention to volume during price breakouts and breakdowns. A breakout accompanied by high volume confirms the strength of the move. A breakout on low volume is more likely to fail. Look for divergences between volume and price. For instance, if price is making new highs, but volume is declining, it could signal weakening momentum and a potential top.

Why Master Wyckoff’s Three Laws?

Wyckoff’s Three Laws provide a powerful framework for understanding market behavior and making informed trading decisions. By mastering these principles, you can:

- Identify High-Probability Trading Opportunities: Recognize when markets are poised for significant moves.

- Improve Your Timing: Enter and exit trades at optimal levels.

- Reduce Risk: Avoid trading in choppy or uncertain market conditions.

- Increase Your Profitability: Generate consistent returns by trading with the underlying market forces.

Don’t Miss Out: Watch the Video Now!

This article provides a comprehensive overview of Wyckoff’s Three Laws. However, the video offers a much more detailed and visually engaging explanation. You’ll see real-world examples of how these laws apply in various market conditions. You’ll also learn practical tips and techniques for incorporating them into your trading strategy.

Click the play button above and unlock the secrets to mastering Wyckoff’s Three Laws! It’s an investment in your trading education that will pay dividends for years to come.