Mastering Elliott Wave Theory for Day Trading: Predict Market Moves with Precision

Unlock Market Secrets: Mastering Elliott Wave Theory for Day Trading

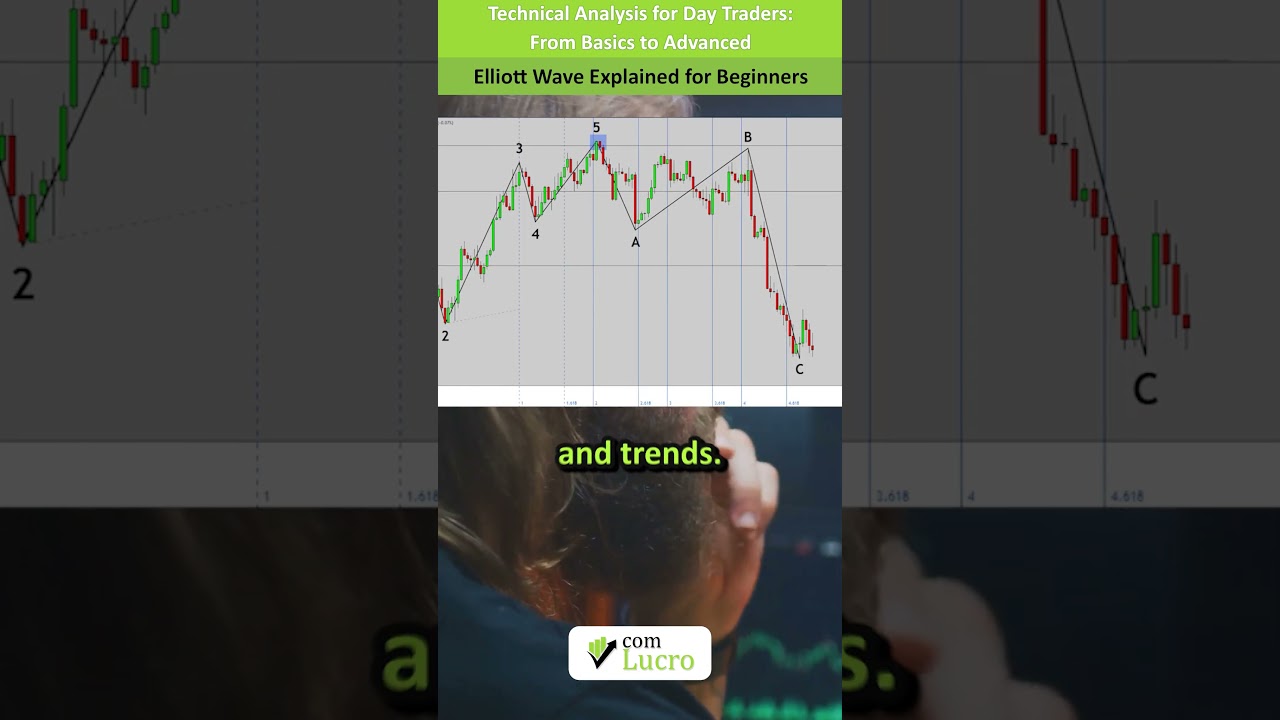

Are you looking for a powerful tool to enhance your day trading strategy? The Elliott Wave Theory offers a unique approach to analyzing market cycles and trends, providing insights that can lead to more informed and profitable trading decisions. This comprehensive guide dives into the core principles of the theory, empowering you to predict market movements with greater precision.

The Elliott Wave Theory, developed by Ralph Nelson Elliott, proposes that market prices move in specific patterns called waves. These patterns are fractal in nature, meaning they repeat themselves on different scales, from short-term day trading charts to long-term investment horizons. Understanding these wave patterns can give you a significant edge in identifying potential entry and exit points.

Why Elliott Wave Theory for Day Trading?

Day trading demands quick decision-making and precise execution. The Elliott Wave Theory provides a framework for understanding the current market context and anticipating future price movements. By recognizing the specific wave patterns, you can:

- Identify High-Probability Trading Setups: Pinpoint moments when the market is likely to reverse or continue its trend.

- Manage Risk Effectively: Set appropriate stop-loss orders and profit targets based on wave structure.

- Improve Timing: Enter and exit trades at optimal times to maximize profits.

Key Concepts of Elliott Wave Theory

The Elliott Wave Theory is based on two main types of waves:

- Motive Waves: These waves move in the direction of the main trend and consist of five sub-waves (labeled 1-5). Waves 1, 3, and 5 are impulse waves, while waves 2 and 4 are corrective waves.

- Corrective Waves: These waves move against the main trend and are typically composed of three sub-waves (labeled A-B-C).

Understanding the characteristics of each wave is crucial for accurate analysis. For example, wave 3 is often the longest and strongest wave in a motive sequence, while wave 4 is typically a corrective wave that retraces a portion of wave 3.

Spotting Key Wave Patterns

Identifying wave patterns requires practice and a keen eye for detail. Here are some tips for spotting key wave patterns in your charts:

- Look for Fibonacci Relationships: Elliott Wave Theory is closely linked to Fibonacci ratios. Use Fibonacci retracements and extensions to identify potential support and resistance levels.

- Consider Volume: Volume often confirms the direction of the wave. Increasing volume during motive waves and decreasing volume during corrective waves can validate your analysis.

- Analyze Chart Patterns: Common chart patterns like triangles, flags, and wedges can often be found within Elliott Wave structures.

Making Smarter Trading Decisions with Elliott Wave Theory

Once you have identified the wave pattern, you can use this information to make more informed trading decisions. For example, if you believe that the market is in wave 3 of a motive sequence, you can look for opportunities to enter long positions with a high probability of success. Conversely, if you believe that the market is in a corrective wave, you can look for opportunities to take profits or enter short positions.

Remember that Elliott Wave Theory is not a perfect science. It’s important to combine it with other technical indicators and risk management techniques to maximize your chances of success. Also, be prepared to adjust your analysis as the market unfolds.

Take Your Trading to the Next Level!

Ready to master the Elliott Wave Theory and gain a significant edge in your day trading endeavors? Watch the full video on the Comm Luk Row Channel now! You’ll learn:

- Detailed explanations of key wave patterns.

- Practical examples of how to apply the theory in real-world trading scenarios.

- Advanced techniques for combining Elliott Wave Theory with other technical indicators.

Don’t miss out on this opportunity to elevate your trading game. Click the link above and start learning today!

Remember to like, subscribe, and hit the notification bell for more game-changing insights. Let’s elevate your trading together!