Order Blocks: The Secret to Precision Entries in Trading

Unlock Precision Entries with Order Blocks in Trading

Are you looking for a way to improve your trading accuracy and align with institutional flows? Then you need to understand Order Blocks. These price zones, where large institutions place significant buy or sell orders, can act as powerful areas of support and resistance, offering high-probability reaction points.

What are Order Blocks?

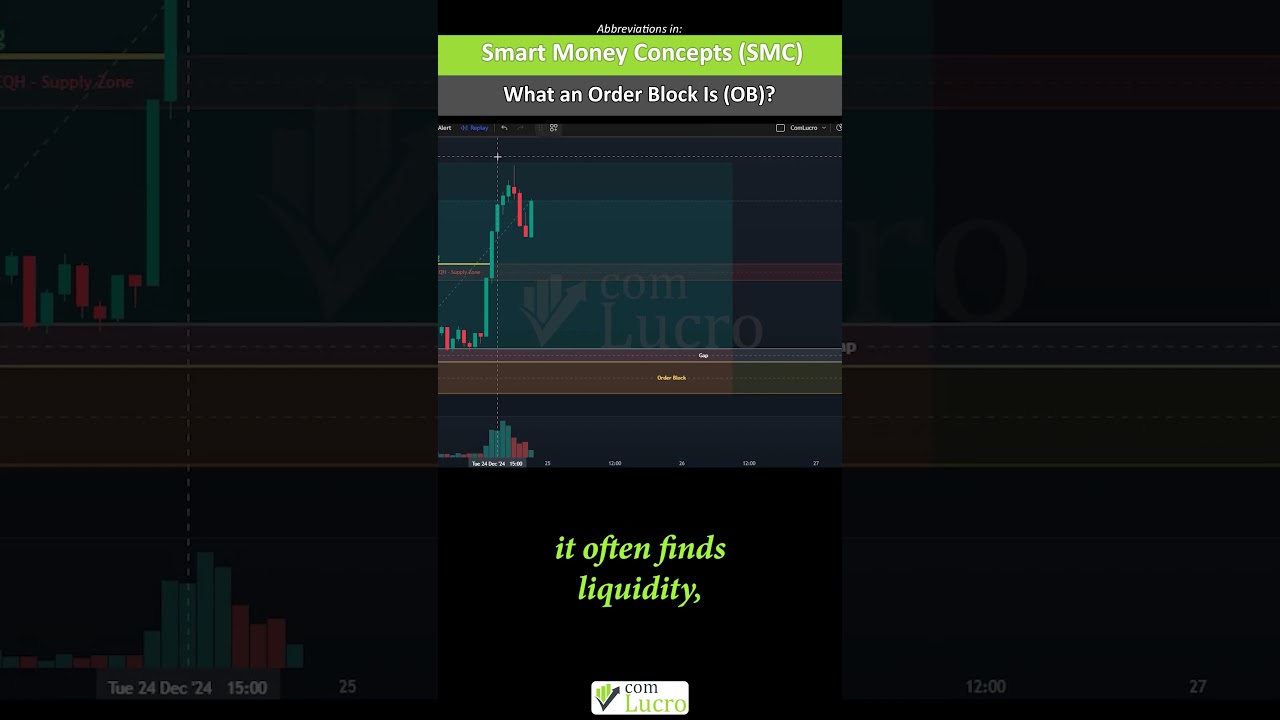

Order Blocks are essentially footprints left by institutions. Before a major price movement, institutions accumulate or distribute their positions. This accumulation or distribution creates a zone, the Order Block. When the price revisits this area, it often finds liquidity, triggering a reaction. Think of it as institutions defending their positions and restarting the move.

But not all support and resistance levels are created equal. Order Blocks stand out because they are formed by high-volume transactions. This makes them more reliable than random levels derived from simple price action.

Why are Order Blocks Important?

Using Order Blocks can significantly refine your trade entries. Instead of entering trades based on gut feeling or less reliable indicators, you can use Order Blocks to pinpoint areas where institutions are likely to defend their positions. This gives you a higher probability of success and tighter stop-loss placement.

How to Identify Strong Order Blocks

The key characteristic of a strong Order Block is its ability to act as a reaction zone. Price should respect the institutional level, bouncing off it or breaking through it with significant momentum. Unlike standard support and resistance, which can be easily broken, Order Blocks represent genuine institutional interest.

To effectively identify Order Blocks, combine them with market structure analysis. Look for Order Blocks that align with the overall trend and key support and resistance levels. This convergence increases the likelihood of the Order Block holding and providing a profitable trading opportunity.

Combining Order Blocks with Market Structure

Don’t just look for Order Blocks in isolation. Integrating them with market structure provides a powerful edge. For instance, an Order Block forming at a key Fibonacci retracement level or a major trendline adds confluence and increases the probability of a successful trade. Consider scenarios where the price breaks a trendline, then retraces to an Order Block located near the broken trendline. This could signal a high-probability shorting opportunity.

Another effective strategy involves identifying Order Blocks within established trading ranges. If the price bounces between support and resistance, look for Order Blocks forming near these levels. A bullish Order Block near the bottom of the range suggests potential buying pressure, while a bearish Order Block near the top indicates potential selling pressure.

Benefits of Using Order Blocks

- Improved Entry Precision: Enter trades closer to institutional levels.

- Reduced Risk: Tighter stop-loss placement due to well-defined zones.

- Increased Probability: Align trades with institutional flow.

- Enhanced Confirmation: Confirm entries using market structure and confluence.

Real-World Examples

Imagine a stock trending upwards. You notice a significant pullback followed by a strong surge in price. The area where the pullback ended and the surge began represents a potential Order Block. When the price retraces back to this zone, you can look for bullish candlestick patterns or other confirming indicators before entering a long position.

Conversely, in a downtrend, a rally followed by a sharp decline marks a potential bearish Order Block. When the price rallies back to this zone, look for bearish signals before entering a short position.

Pitfalls to Avoid

It’s crucial to avoid common mistakes when trading Order Blocks. Don’t blindly trade every Order Block you see. Look for confluence with market structure and other indicators. Avoid trading against the overall trend. Always use proper risk management techniques, including stop-loss orders, to protect your capital.

Don’t Miss Out: Master Order Blocks Today!

Want to dive deeper into the world of Order Blocks and unlock their full potential? Then you absolutely *must* watch our video, “Order Blocks Explained.” In this video, we break down the concept of Order Blocks in detail, providing practical examples and actionable strategies that you can implement immediately. You’ll learn how to identify strong Order Blocks, combine them with market structure, and use them to improve your trading accuracy. Don’t miss this opportunity to elevate your trading game! Click here to watch the video now!