The PERFECT Smart Money Entry REVEALED! 🔥 Master Institutional Trading

Unlock the Secrets of Perfect Entries with Smart Money Concepts

Are you struggling to find consistent and profitable entries in the market? Do you want to trade like the institutions and understand how smart money moves? Then you’ve come to the right place. This article will break down the core principles of Smart Money Concepts (SMC) and reveal how you can identify and execute the perfect entry.

This strategy focuses on understanding market structure, identifying key supply and demand zones, and recognizing liquidity grabs. By aligning your trades with institutional order flow, you can significantly improve your win rate and maximize your risk-reward ratio.

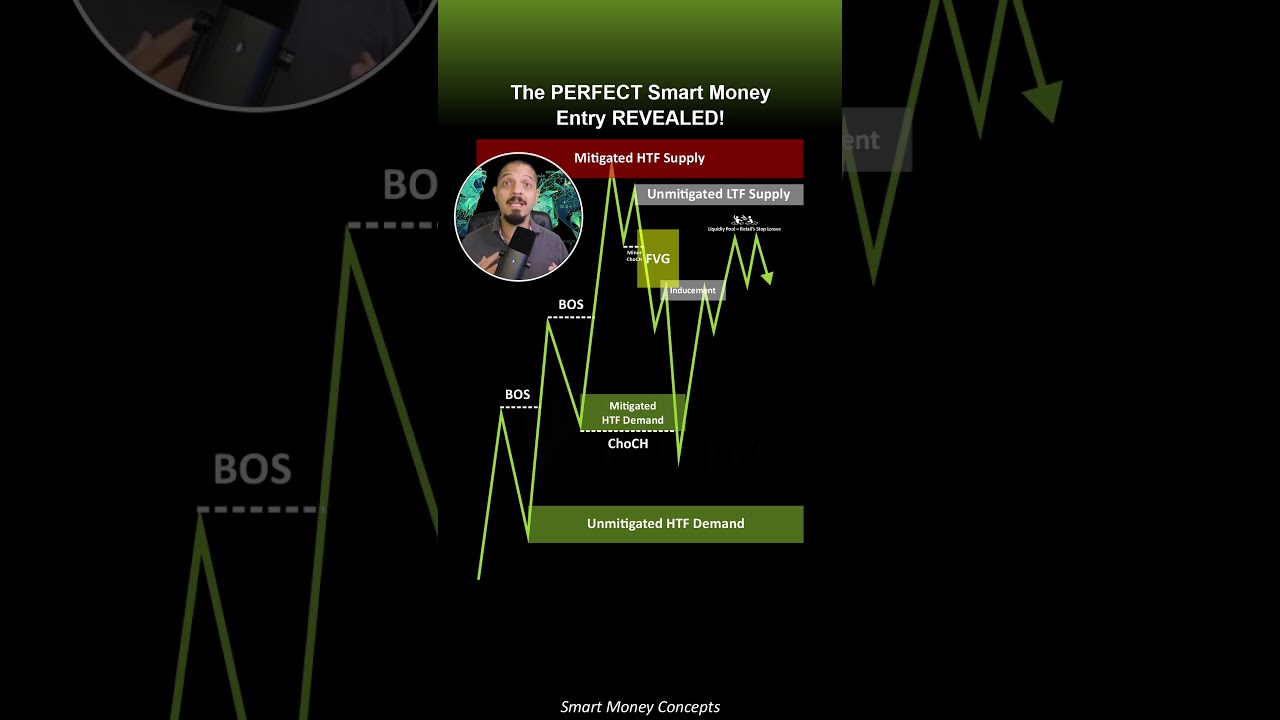

Before we dive deeper, watch this video for a visual explanation and practical examples of the perfect Smart Money entry:

Understanding Market Structure and Institutional Order Flow

The foundation of any successful trading strategy is a solid understanding of market structure. The market naturally moves in trends, forming higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend. Smart Money Concepts emphasize identifying these structural breaks to anticipate potential trend reversals.

Key elements to watch for:

- Breaks of Structure (BOS): Confirmation of a trend continuation.

- Unmitigated Demand/Supply Zones: Areas where institutional orders remain unfilled. These zones act as magnets for price.

- Change of Character (CHoCH): The first sign of a potential trend shift, signaling a shift in market sentiment.

The Role of Supply and Demand Zones

Institutional traders operate with significant capital, and their actions leave footprints in the market in the form of supply and demand zones. These zones represent areas where large orders were placed, either to buy (demand) or sell (supply). Identifying these zones is crucial for anticipating future price movements.

The video highlights the importance of distinguishing between higher time frame (HTF) and lower time frame (LTF) zones. Unmitigated HTF demand areas provide strong support during an uptrend, while strong supply zones signal potential reversal points.

The Inducement and Liquidity Grab Strategy

A critical aspect of the perfect Smart Money entry is understanding the concept of inducement and liquidity grabs. Institutions often manipulate price to induce retail traders into taking positions in the wrong direction, only to sweep their stop losses and capitalize on the liquidity.

Inducement: A false signal that lures retail traders into entering a trade prematurely. This often occurs near supply or demand zones.

Liquidity Grab: The act of institutions sweeping stop losses to accumulate orders at a favorable price.

The perfect entry occurs when price grabs liquidity near an inducement zone and taps into an unmitigated lower time frame supply zone (in a bearish scenario). This confluence of factors creates a high-probability setup for a successful trade.

Practical Example: Bearish Scenario

- The market is in an uptrend, creating higher highs and higher lows.

- Price reaches a strong supply zone where smart money begins distributing positions.

- A minor change of character occurs, followed by the formation of inducement.

- A major change of character signals a potential trend shift.

- Price grabs liquidity in the inducement zone and taps into the unmitigated lower time frame supply zone.

- Enter the trade with a stop loss above the mitigated higher time frame supply zone.

- Target the first breaks of structure after the major change of character.

Risk Management and Target Setting

Risk management is paramount to any trading strategy. The video emphasizes setting your stop loss above the mitigated higher time frame supply zone to protect your capital from unexpected price fluctuations. A high risk-to-reward ratio is crucial for long-term profitability.

Target selection should be based on market structure. Aim for the first breaks of structure after the major change of character. This provides a realistic and achievable target while maximizing your potential profit.

Why You Need to Watch the Full Video

This article provides a foundational understanding of the perfect Smart Money entry. However, the video offers a much more in-depth explanation with visual examples and practical tips that can significantly improve your trading performance. By watching the full video, you’ll learn:

- How to identify key supply and demand zones with precision.

- The nuances of inducement and liquidity grabs.

- Effective risk management techniques.

- How to align your trades with institutional order flow.

Don’t miss out on this valuable opportunity to master Smart Money Concepts and elevate your trading game. Watch the video now and unlock the secrets to consistent and profitable entries!

Also, be sure to check out the full Smart Money Concepts course available for free on our channel. We break down all the key concepts like fair value gap, order block, change of character, and much more in a clear, step-by-step format to help you trade with confidence and precision!