The Shocking Truth About Traders: 43 Million Trades Analyzed

Unveiling the Hidden Truths of Trading: A Deep Dive into 43 Million Trades

What separates successful traders from those who struggle? A massive study analyzing 43 million trades from 25,000 traders reveals some startling insights. This isn’t just anecdotal evidence; it’s a large-scale analysis that exposes common pitfalls and highlights crucial areas for improvement. The research, conducted by Rodriguez from FCM, a prominent broker, covered a 15-month period, providing a comprehensive view of trader behavior.

The Paradox of Winning More Than Losing

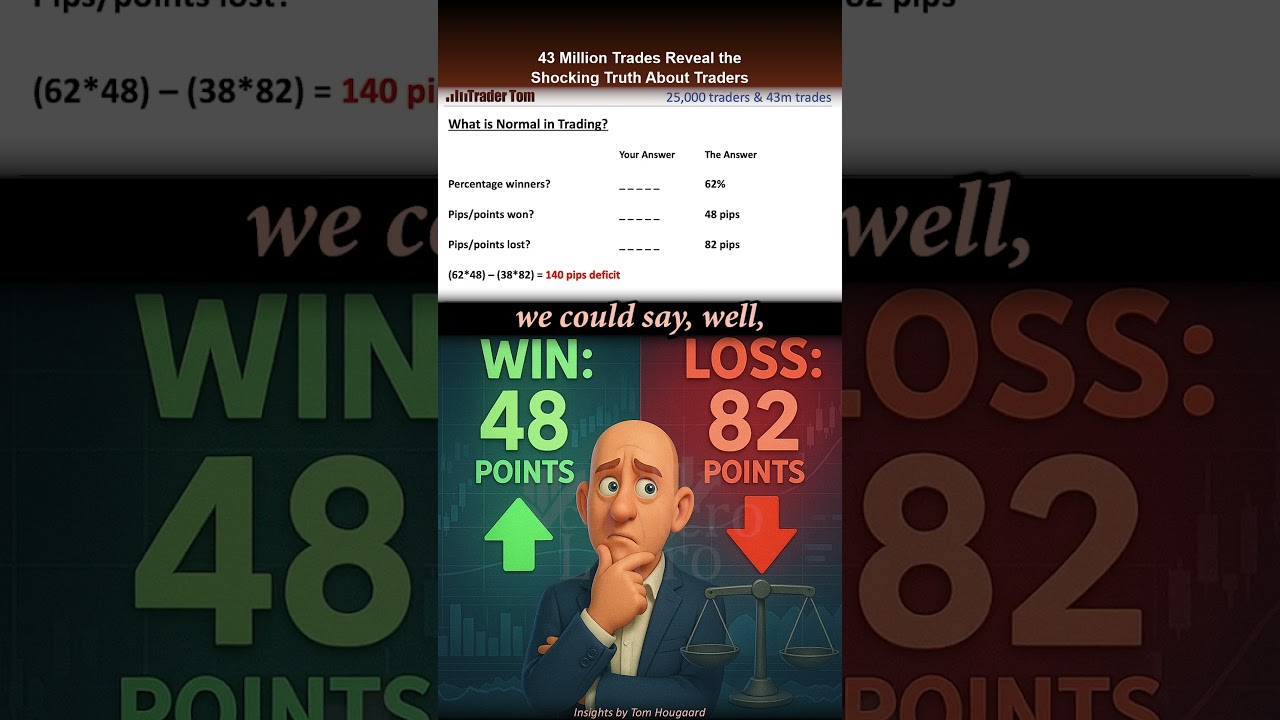

The most surprising finding? The traders in the study actually had more winning trades than losing trades. In fact, they boasted an impressive hit rate of 62%. This seemingly positive statistic masks a critical flaw that ultimately leads to losses.

The Fatal Flaw: Risk Management Gone Wrong

The problem wasn’t the frequency of wins, but the *size* of the wins versus the *size* of the losses. On average, these traders won 48 points on their winning trades, while they lost a staggering 82 points on their losing trades. This disparity highlights a fundamental issue in risk management.

Think about it: even with a 62% win rate, consistently losing more on losing trades than you gain on winning trades is a recipe for disaster. It’s like filling a bucket with a small hole – you might pour water in faster than it leaks out for a while, but eventually, the bucket will empty.

Why This Data Matters to You

This study transcends individual performance. Analyzing the behavior of 25,000 traders over such a large sample space eliminates the excuse of “bad luck.” It exposes a systematic pattern of poor risk management that plagues a significant portion of the trading population. It demonstrates the critical importance of risk-reward ratio, highlighting that a high win rate alone is insufficient for consistent profitability.

The Euro Dollar Connection

Most of these 43 million trades were executed in the Euro Dollar (EUR/USD) currency pair, one of the most liquid instruments globally. This reinforces the validity of the findings, as the liquidity of the market eliminates concerns about manipulation or unusual price fluctuations.

Turning the Tide: Practical Steps for Improvement

So, how can you avoid falling into the same trap? Here are a few key takeaways:

* **Prioritize Risk Management:** Focus on setting appropriate stop-loss orders and sticking to them. Don’t let emotions dictate your trading decisions.

* **Optimize Risk-Reward Ratio:** Aim for a risk-reward ratio of at least 1:2, meaning you’re risking one unit to potentially gain two. Ideally, aim for 1:3 or higher. This ensures that your winning trades more than compensate for your losing trades.

* **Analyze Your Own Trades:** Regularly review your trading performance, paying close attention to your win rate and average win/loss size. Identify areas where you can improve.

* **Develop a Trading Plan:** A well-defined trading plan should include specific entry and exit rules, risk management parameters, and position sizing strategies. This provides a framework for making disciplined trading decisions.

Don’t Be a Statistic: Watch the Video and Learn More!

This article only scratches the surface of the insights revealed by this groundbreaking study. **To fully understand the implications and learn actionable strategies for improving your trading performance, watch the video!** You’ll gain a deeper understanding of risk management, trader psychology, and the critical factors that separate successful traders from the rest. Don’t miss out on this valuable knowledge – your trading account will thank you!

Click play now to unlock the secrets to consistent trading profitability!