Trader, Are You Making This Mistake? Avoid This Critical Trading Error

Trader, Are You Making This Mistake? Unveiling the Key to Consistent Profits

Are you a trader struggling to achieve consistent profitability? Do you find yourself breaking even despite putting in the effort? The key might lie in a critical mistake many traders unknowingly make: not scaling up winning positions. In this article, we’ll delve into this common pitfall and provide actionable strategies to overcome it, drawing insights from a seasoned trading expert. Understand how crucial it is to risk a manageable amount per trade and, more importantly, how to capitalize on your winning trades.

The Danger of Symmetrical Risk

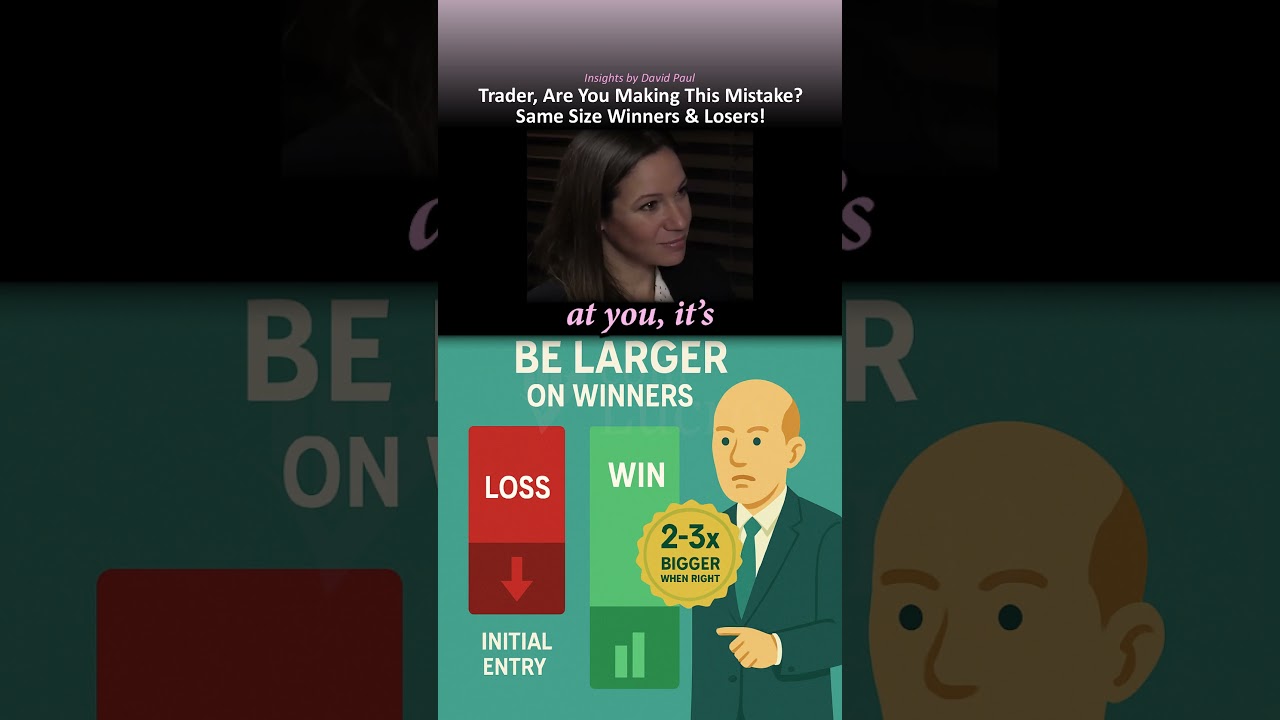

Many traders approach the market with a symmetrical risk profile, meaning they risk the same amount on losing trades as they gain on winning trades. While this might seem balanced, it often leads to breaking even at best. The speaker in the video emphasizes the importance of being significantly larger when you’re right than when you’re wrong. This is the crucial shift needed to transform from a breakeven trader to a consistently profitable one. As the speaker puts it, “…if there’s one way to really cause money to come running at you it’s being bigger when you’re right than you are when you’re wrong…”

Risk Management: The Foundation of Success

The video highlights the importance of strict risk management. Starting with a small percentage of your portfolio at risk on any single trade is crucial. The speaker initially risks about half a percent on any one trade, especially short-term trades, and even less (about a third of a percent) on very short-term positions. This approach allows you to withstand losing streaks without significant capital erosion.

Setting Your Stop-Loss

The distance between your entry point and stop-loss should correlate directly with the percentage of your portfolio you’re willing to risk. This ensures that even if the trade goes against you, the loss remains within your predetermined risk parameters.

The Power of Adding to Winning Positions

The real game-changer is adding to your winning positions. Once a trade moves in your favor, strategically increasing your position size amplifies your profits. The speaker suggests, on a 4-hour chart of the forex market, aiming to be two or three times bigger when you’re right than when you’re wrong. This aggressive, yet calculated, approach is what separates successful traders from those who remain stuck in a cycle of breaking even.

Overcoming the Fear of Letting Profits Slip

Adding to winners can be psychologically challenging. It’s tempting to take profits early, especially after seeing a gain. The video acknowledges this difficulty, pointing out how easy it is to rationalize taking profits when they’re available. However, resisting this urge and trusting your strategy is essential for maximizing gains.

Why Traders Break Even: A Common Scenario

The video addresses a common question from traders: “I’m not losing any money, but I’m not making any money – how can I make some money?” The answer, according to the speaker, invariably lies in the trader’s inability to scale up their winning positions. They’re the same size when they’re right as when they’re wrong, effectively capping their potential profits.

Actionable Steps to Implement Today

- Define Your Risk Tolerance: Determine the maximum percentage of your portfolio you’re willing to risk on a single trade (e.g., 0.5% or less).

- Set Appropriate Stop-Loss Orders: Ensure your stop-loss orders align with your risk tolerance and the volatility of the asset you’re trading.

- Identify Opportunities to Add to Winners: Develop a strategy for identifying when and how to add to your winning positions (e.g., based on price action, chart patterns, or fundamental analysis).

- Manage Your Emotions: Resist the urge to take profits prematurely. Trust your strategy and allow your winning trades to run.

Don’t Stay Stuck in Neutral! Watch the Full Video Now!

This article provides a glimpse into the critical mistake many traders make. To truly understand the nuances of risk management and position sizing, you need to watch the full video! You’ll gain invaluable insights into:

- Precise risk management techniques for short-term and long-term trades.

- The psychology behind adding to winning positions and how to overcome fear.

- Real-world examples of how to implement this strategy effectively.

Stop leaving money on the table! Click play now to unlock the secrets to consistent trading profitability!