Master Fair Value Gaps for Profitable Trades!

📈 Fair Value Gaps (FVGs): Your Secret to Trading Success!

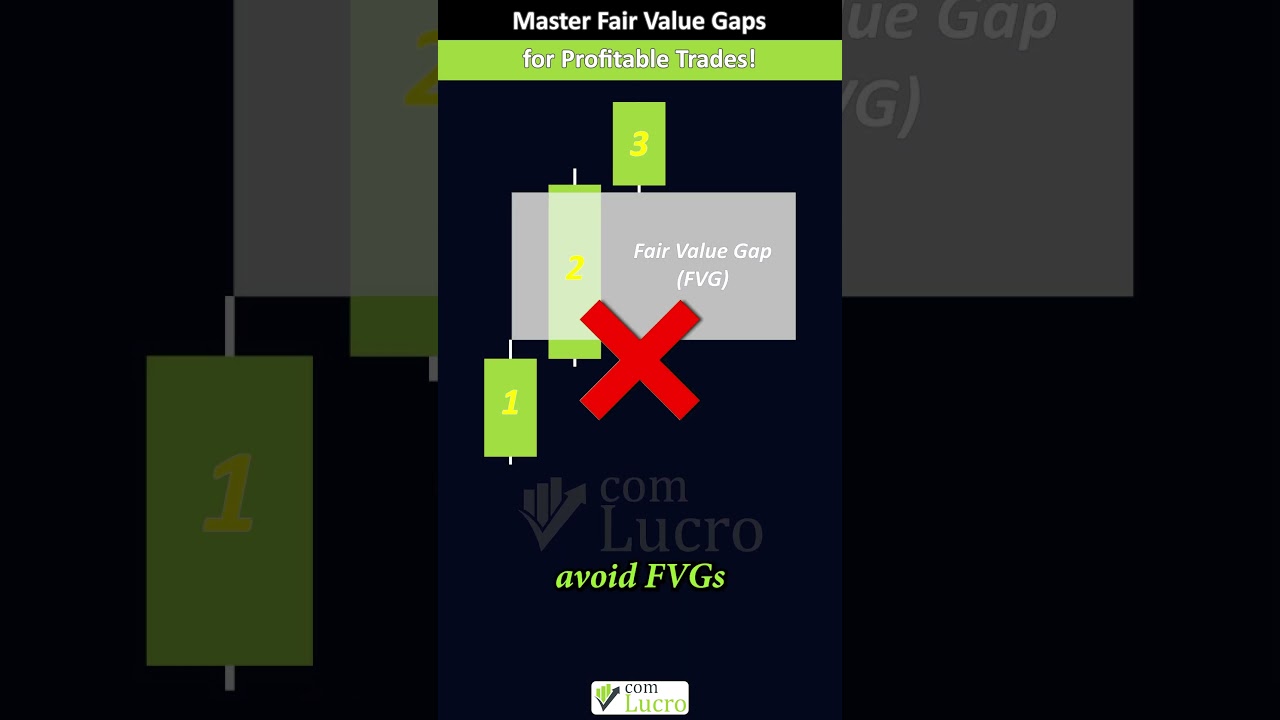

Ready to enhance your trading skills? In this video, we explore Fair Value Gaps (FVGs)—a powerful concept involving a three-candle formation that can significantly boost your trading edge. Learn how to filter for the most successful setups and avoid costly mistakes.

🔑 Key Topics Covered:

The anatomy of an FVG: 3-candle formation explained

Why some FVGs work while others fail

The importance of the third candle’s behavior

Filtering high-probability setups for premium results

Practical tips to maximize your trading profits

👉 Don’t miss these valuable insights to level up your trading game!

🔔 Subscribe for more trading strategies: https://comlucro.com.br/youtube

🌐 Explore More: https://www.comlucro.com.br/

#FairValueGaps #TradingStrategies #CandlePatterns #PriceAction #DayTrading #StockTrading #MarketAnalysis #FinancialMarkets #TradingTips #TradingEdge

00:00:00,120 --> 00:00:29,527

Let’s talk about Fair Value Gaps, or FVGs.

A concept that can significantly improve

00:00:29,527 --> 00:00:29,623

your trading edge. A FVG involves a specific

three-candle formation. When identified correctly,

00:00:29,623 --> 00:00:29,712

it can lead to highly profitable trades.

However, not all FVG are the same. For example,

00:00:29,712 --> 00:00:29,810

this FVG worked well, but this one didn’t. So,

how can we filter for the most successful setups?

00:00:29,810 --> 00:00:29,907

As mentioned earlier, a FVG always consists of

three candles. The first candle must be green but

00:00:29,907 --> 00:00:30,280

can have any shape. The second candle drives the

action, showing a sharp, decisive move that sets

00:00:30,280 --> 00:00:34,200

the tone. Now, the third candle is

key. A strong bullish breakout above

00:00:34,200 --> 00:00:37,880

the second candle signals the price may

continue higher without filling the gap.

00:00:37,880 --> 00:00:41,720

Here’s the key: avoid FVGs where

the third candle breaks and runs,

00:00:41,720 --> 00:00:45,200

especially if they appear in the premium

zone for long trades or the discount zone

00:00:45,200 --> 00:00:49,440

for short trades. We want a third candle

that consolidates, as this increases the

00:00:49,440 --> 00:00:53,400

likelihood of the price returning to fill the

gap. This setup provides a clean entry point,

00:00:53,400 --> 00:00:56,760

allowing us to capitalize on the

move and secure profits confidently.

00:00:56,760 --> 00:00:59,800

Please, keep our top recommendations in

mind and best of luck in your trades.