Master Fractal Price Action: Higher vs. Lower Timeframes!

🕵️ Did you know that a single candlestick on a higher timeframe can reveal an entire chart pattern on a lower timeframe?

This happens because price action is fractal—meaning that what appears as a simple candle on a daily chart can actually break down into complex structures like flags, pennants, or wedges when viewed on smaller timeframes.

📊 Examples:

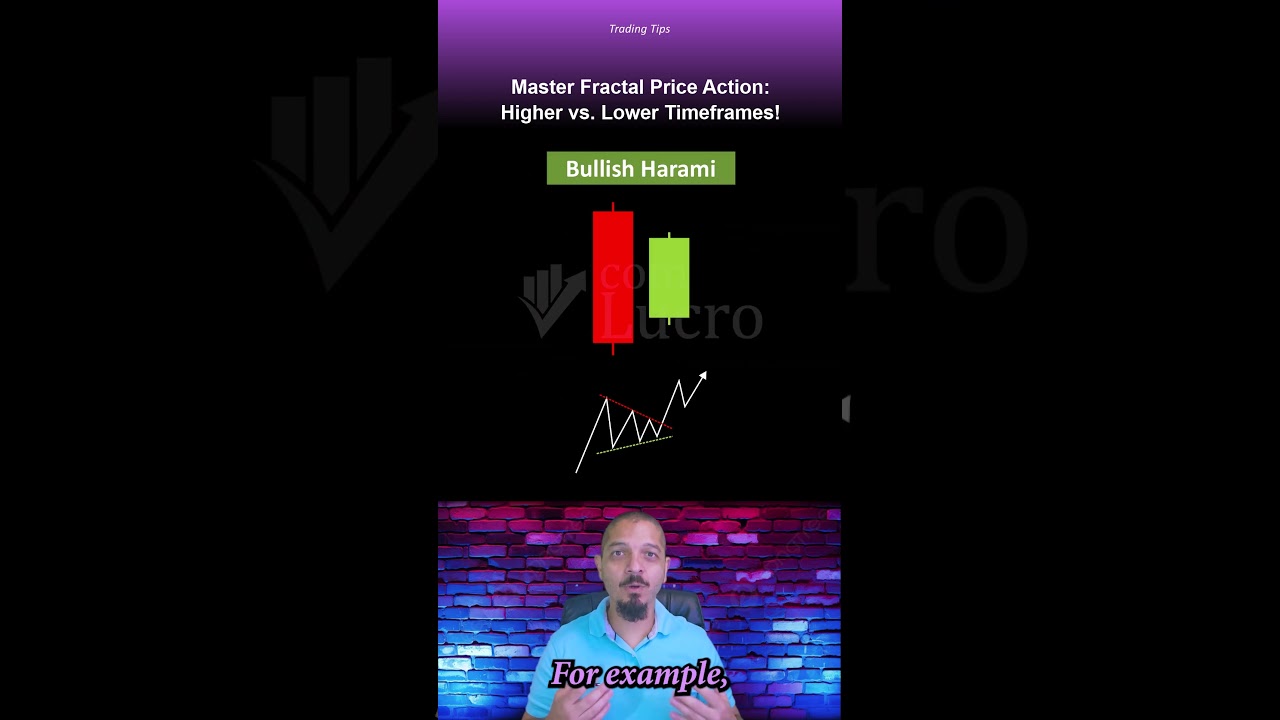

✅ A Bullish Harami on the daily chart could be a bullish pennant or a falling wedge on a lower timeframe.

✅ A Bearish Pinbar might represent a head and shoulders pattern, signaling a potential reversal.

🔎 Why does this matter?

Helps you spot trends early

Refines your trade entries

Improves your confirmation strategies

👀 Next time you see a strong candlestick pattern, zoom in and analyze what’s happening on lower timeframes. You might just uncover a game-changing setup!

📈 Want to master price action trading? Subscribe now for more insights!

📺 YouTube: https://comlucro.com.br/youtube

🌐 Website: https://www.comlucro.com.br/

📊 TradingView: https://www.tradingview.com/?aff_id=119375

#Trading #CandlestickPatterns #PriceAction #FractalTrading #TechnicalAnalysis #Forex #DayTrading #SwingTrading #StockMarket #CryptoTrading #ChartPatterns

00:00:00,080 --> 00:00:04,080

Trader did you know that a Candlestick

00:00:02,120 --> 00:00:06,000

pattern on a higher time frame can

00:00:04,080 --> 00:00:08,320

represent an entire chart formation on a

00:00:06,000 --> 00:00:10,599

lower time frame this is because price

00:00:08,320 --> 00:00:12,880

action is fractal what looks like just

00:00:10,599 --> 00:00:14,519

one candle pattern on a daily chart can

00:00:12,880 --> 00:00:17,000

break down into a full structure when

00:00:14,519 --> 00:00:18,960

analyzed on smaller time frames for

00:00:17,000 --> 00:00:20,800

example a bullish harami on the daily

00:00:18,960 --> 00:00:23,080

chart might actually be a bullish

00:00:20,800 --> 00:00:25,000

pennant or a falling wedge when viewed

00:00:23,080 --> 00:00:27,480

on a lower time frame signaling a

00:00:25,000 --> 00:00:29,359

potential continuation likewise a

00:00:27,480 --> 00:00:31,480

bearish pin bar could represent a head

00:00:29,359 --> 00:00:32,520

and shoulders information indicating a

00:00:31,480 --> 00:00:34,200

possible

00:00:32,520 --> 00:00:35,879

reversal understanding how these

00:00:34,200 --> 00:00:38,280

patterns align across different time

00:00:35,879 --> 00:00:40,559

frames helps you spot Trends early

00:00:38,280 --> 00:00:42,640

refine your entries and improve trade

00:00:40,559 --> 00:00:44,480

confirmations so next time you see a

00:00:42,640 --> 00:00:46,399

strong Candlestick pattern take a step

00:00:44,480 --> 00:00:48,600

back and think what does it look like on

00:00:46,399 --> 00:00:52,440

a lower time frame please keep this in

00:00:48,600 --> 00:00:52,440

mind and best of luck in your trades

Perguntas Respondidas por esse Artigo

-

O que significa dizer que a ação do preço é fractal?

-

Como um padrão de candlestick em um timeframe maior pode se manifestar em um timeframe menor?

-

Quais são os benefícios de analisar a ação do preço em diferentes timeframes?

-

Onde posso encontrar mais informações sobre price action e padrões de candlestick?